欧盟统计局(Eurostat)周四(10月16日)公布的数据显示,欧元区9月消费者物价指数(CPI)终值年率升幅从8月的0.4%降至0.3%,为2009年10月以来最低水平,符合预期和初值。

具体数据显示,欧元区9月CPI月率升幅为0.4%,符合预期,8月升幅为0.1%。

欧元区9月核心CPI年率升幅为0.8%,8月升幅为0.7%;9月核心CPI月率升幅为0.5%,8月升幅为0.3%。

更综合的一组数据显示,欧盟试图避免物价持续下跌的努力遭遇挫折。欧盟9月CPI年率上升0.4%,低于8月的0.5%,并且为2009年9月以来的最低同比升幅。

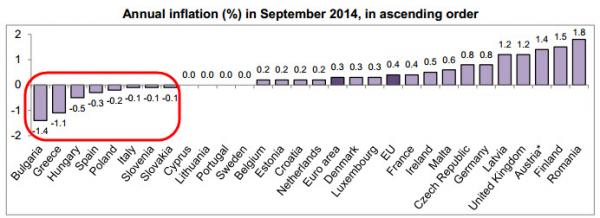

统计数据显示,8个欧盟成员国CPI年率录得下降,其中有5个是欧元区成员国,即希腊、西班牙、意大利、斯洛文尼亚和斯洛伐克,另外三个不使用欧元的欧盟成员国是保加利亚、匈牙利和波兰。

这些数据将很可能加剧投资者对欧洲通缩风险增加的恐惧,这种担忧情绪使得世界各地资产价格下降。

鉴于通胀率如此低,欧元区难以承受住太多冲击,例如德国经济的疲软或乌克兰附近的地缘政治紧张局势,这种冲击或都使整个欧元区陷入通缩。

欧洲央行(ECB)行长德拉基(Draghi)在今年6月份和9月份均采取措施对抗通缩,两次降息将利率推至新低,包括存款负利率,并推出新的银行贷款和购买资产支持证券(ABS)和担保债券(CB)计划。

但更加戏剧性的措施并不完全一致,美联储(FED)采取很少的货币刺激措施,英国央行(BOE)和日本央行(BOJ)已经开始大规模地购买政府债券来增加货币供应量。

欧盟统计局公布的其他数据显示,欧元区8月国内需求疲软。尽管欧元区贸易顺差扩大至92亿欧元(116美元),2013年8月为73亿欧元。季调后贸易帐增长是受进口下降推动而不是因为出口回升。的确,出口从7月下跌0.9%,为连续第三个月下跌,而进口下跌3.1%。

出口下降对欧元区经济而言是个坏消息,其在第二季度依靠贸易避开紧缩。伴随着高失业率和低薪资增长,政府财政紧缩计划依旧保持内需疲软,许多企业已经开始在欧元区以外地区投资。

But there is little consensus for more-dramatic measures--the kind of monetary stimulus the Fed, the Bank of England and the Bank of Japan have deployed--namely large-scale purchases of government bonds to raise the money supply.

There was a small sliver of good news in Thursday's figures. In its preliminary estimate, Eurostat had calculated that the core rate of inflation for the eurozone--which strips out volatile items such as energy and food--had fallen to 0.7% from 0.9% in August.

Speaking in his monthly press conference, Mr. Draghi acknowledged that was a worry, since it indicated the downward pressure on prices had spread beyond food and energy and may increasingly reflect weak domestic demand. But Eurostat Wednesday raised its estimate of core inflation to 0.8%.

Other figures released by Eurostat pointed to a weakening of domestic demand in August. Although the eurozone's trade surplus widened to 9.2 billion euros ($11.68 billion) from EUR7.3 billion in August 2013, seasonally adjusted figures showed that was driven by a decline in imports rather than a pickup in exports. Indeed, exports fell 0.9% from July, the third straight month of decline, while imports fell by 3.1%.

The decline in exports is bad news for the eurozone economy, which relied on trade to help stave off a contraction in the second quarter. With high unemployment, low growth in wages and government austerity programs still keeping domestic demand anemic, many businesses have had to look outside the currency area.

[责任编辑: 林天泉]